Interim Financial Information For The Six Months And Full Year Ended 31 December 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

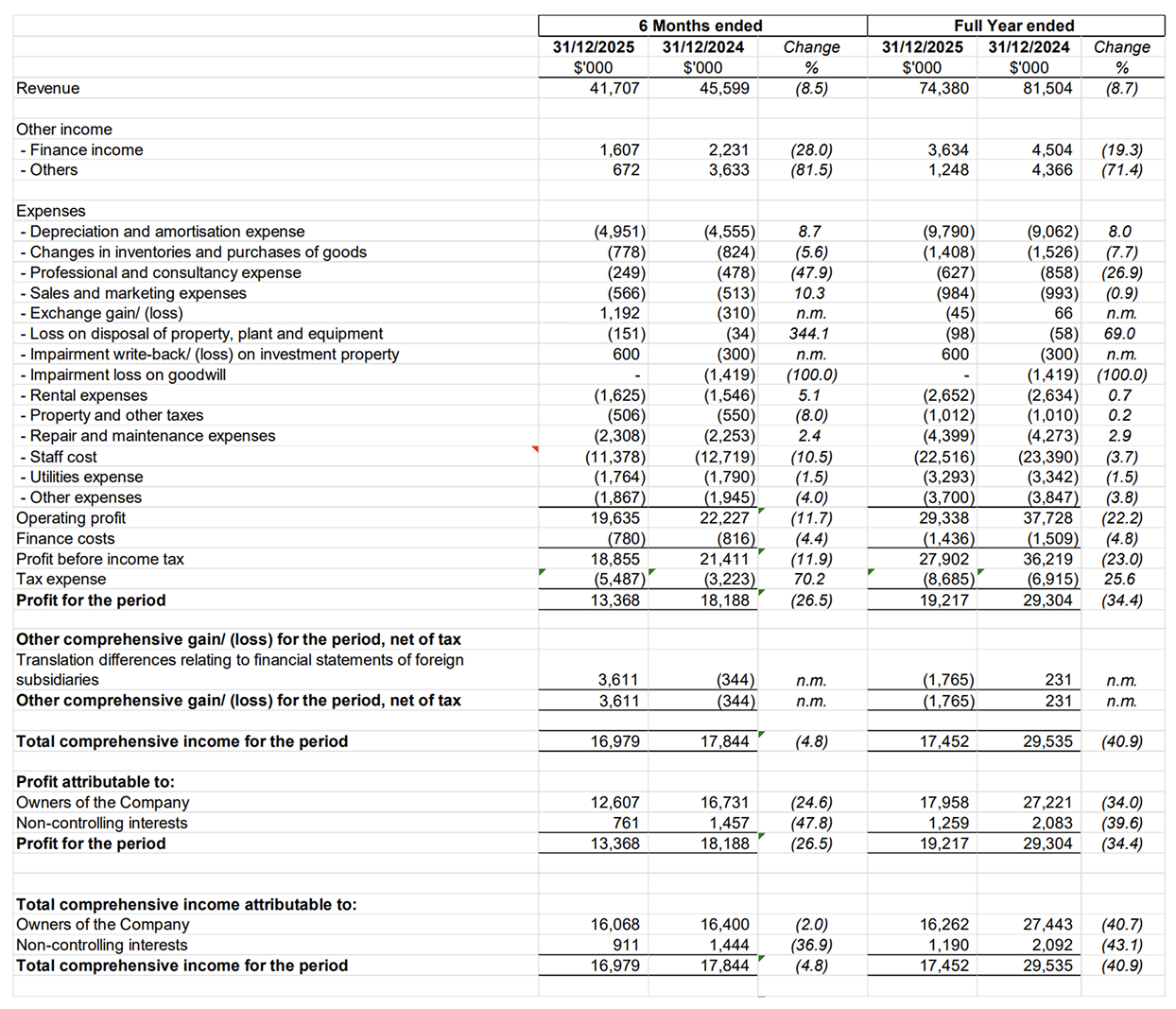

Consolidated Statement of Profit or Loss and Other Comprehensive Income

n.m. – not meaningful

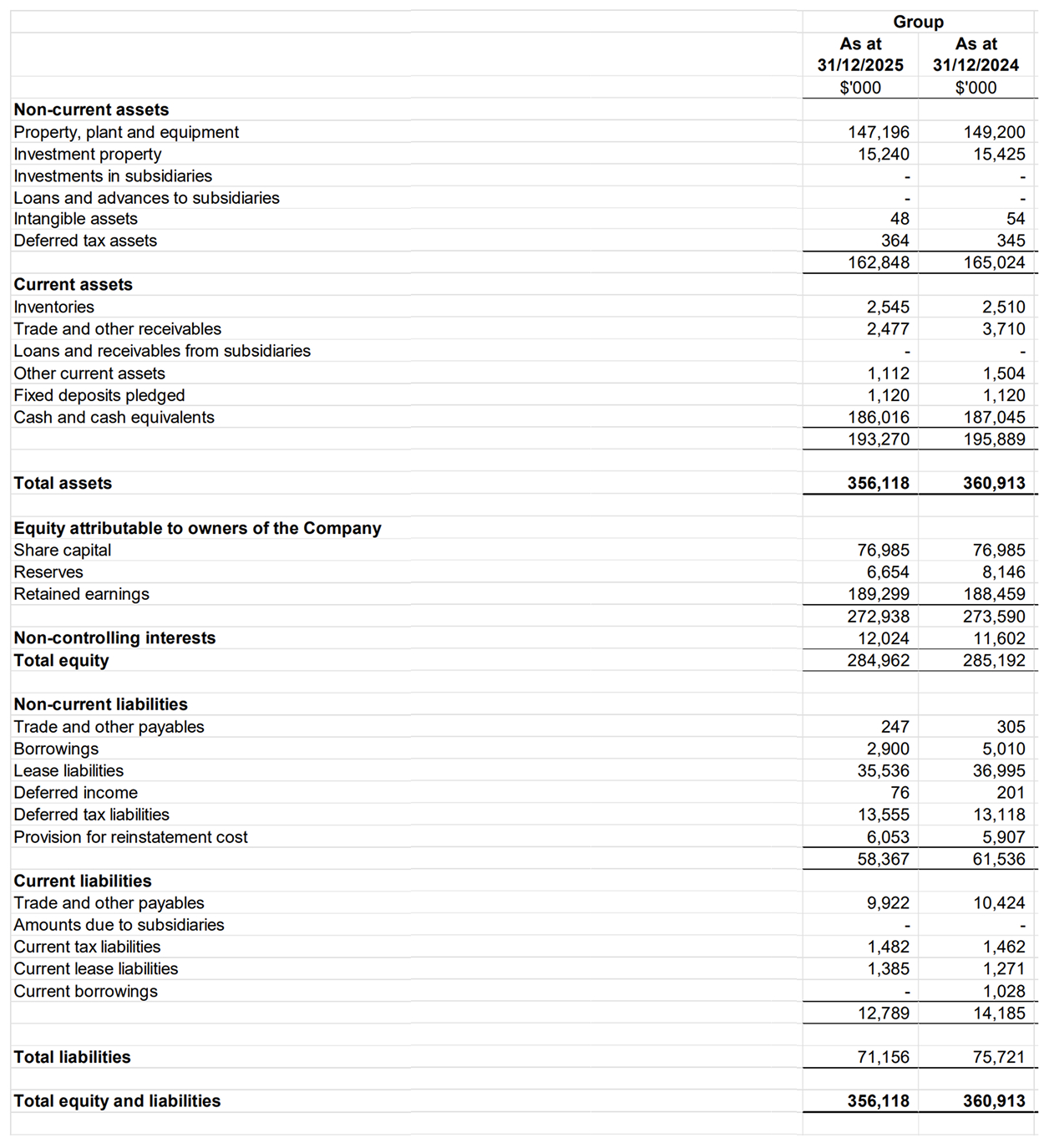

Consolidated Statement of Financial Position

Review of performance of the Group

Revenue

In the second half of FY2025, the Group generated revenue of $41.71 million, 8.5% lower than the corresponding period in 2H2024. Revenue generated by Singapore Flyer as well as our aquarium at Xiamen and Cable Car facility at Xi’an were lower than 2H2024 mainly due to lower visitor arrivals. This was partly mitigated by higher revenue generated by our flagship Shanghai Ocean Aquarium which received more visitors during the period compared to 2H2024.

Overall visitation to all our attractions totalled 1.65 million visitors for 2H2025, 12.1% lower than the corresponding period of 1.88 million visitors in 2H2024.

Cumulatively, overall revenue for the full year of FY2025 amounted to $74.38 million, 8.7% lower than FY2024.

Finance income for 2H2025 decreased 28% from 2H2024, mainly due to falling interest rates for bank deposits. Other income decreased significantly from 2H2024, mainly due to the absence of a $3.0 million settlement fee received in 2H2024 from the contractor who carried out works on the Singapore Flyer during its inception.

Operational Results

Total Expenses (excluding finance cost) for 2H2025 was $24.35 million, 16.7% lower than 2H2024. Exchange gain of $1.2 million was recorded in this period, as Renminbi strengthened against the Singapore Dollar in the current period. Excluding the exchange gain or loss in both periods, total expenses would have been about 11.7% lower than corresponding period.

Professional and consultancy expenses decreased, as 2H2024 expense included legal and professional fee relating to the spoke cable issues. Loss on disposal of property, plant and equipment increased, mainly due to write-offs of old renovation project and construction costs relating to certain exhibition zone and classroom facility, as well as cost relating to roof repair works at our Shanghai aquarium. Staff cost decreased, mainly due to lower amount of performance bonus being accrued in the current period.

Impairment write-back amounting to $0.6 million was recorded on the investment property at Singapore Flyer.

Profit before tax was $18.86 million for 2H2025, 11.9% lower than the profit before tax of $21.41 million recorded in 2H2024. Excluding the exchange gain/ loss and the one-off impairment losses in both periods, as well as the settlement fee received in 2H2024, profit before tax for 2H2025 would have been $17.06 million, 16.5% lower than the profit before tax of $20.44 million in 2H2024.

Cumulatively, profit before tax was $27.90 million for FY2025, 23% lower than the profit before tax of $36.22 million in FY2024. Similarly, excluding the exchange gain/ loss and one-off items mentioned above; profit before tax for FY2025 would have been $27.35 million, 21.6% lower than the profit before tax of $34.87 million for FY2024.

Balance Sheet items

Intangible assets decreased 11.1% from $54,000 at 31 December 2024 to $48,000 at 31 December 2025, due to current year addition offset by periodic recognition of amortisation in the current year.

Trade and other receivables decreased 33.2% from $3.71 million at 31 December 2024 to $2.48 million at 31 December 2025, mainly due to receipt of 2023 wage support grant in the current year and decrease in interest receivable from fixed deposits placed with financial institutions.

Other current asset decreased 26.1% from $1.50 million at 31 December 2024 to $1.11 million at 31 December 2025, mainly due to decrease in prepayments at Singapore Flyer arising from the completions of the external cabin repainting works, development of HiFlyer and Flyer360 apps, IoT smart monitoring project and, upgrading of POS system.

Reserves decreased 18.3% from $8.15 million at 31 December 2024 to $6.65 million at 31 December 2025, due to the increase in treasury shares of $0.1 million arising from the share buyback during the current period, and translation loss of $1.69 million arising from the weaker RMB against SGD at the end of the current year compared to the end of last year; offset by increase in share option reserves arising from the share option expense recognised for options granted in May 2024 and May 2025, and increase in general reserve arising from the reserve amount set aside by LLC prior to the distribution of retained profit as dividend during the year.

Non-current trade and other payables decreased 19.0% from $0.31 million at 31 December 2024 to $0.25 million at 31 December 2025, mainly due to rental deposits from certain retail tenants being reclassified from non-current to current payables when the remaining lease is expiring within the next 12 months, offset by rental deposit received from a new tenant as well as a top-up of deposit by an existing tenant whereby the leases expiry date is more than 12 months.

Deferred income decreased 62.2% from $0.20 million at 31 December 2024 to $76,000 at 31 December 2025, due to the periodic recognition of deferred income to profit & loss in the current year, partly offset by grants totalling to $81,000 received during the year.

Cash Flow Statement

Net cash of $16.00 million from operating activities was recorded in 2H2025, 32.5% lower than corresponding period. Purchase of property, plant and equipment included cost of re-development of Time Capsule Phase 2 at Singapore Flyer. Repayment of borrowings included a repayment of shareholder’s loan of $1.5 million to a minority interest of a subsidiary and full repayment of the outstanding temporary bridging loan taken up in July 2021 by Singapore Flyer.

As at 31 December 2025, the Group’s cash and cash equivalent balance amounted to $186.02 million.

Commentary

China’s gross domestic product (“GDP”) grew 5% year-on-year in 2025, fully achieving the main goals and tasks for economic and social development in its 14th five-year plan period (2021 to 2025), the National Bureau of Statistics of China reported.

In Shanghai, a three-year action plan starting 2025 has been introduced to promote the high-quality development of the city’s tourism industry. Inbound tourism hit a new record of 9.36 million visits in 2025, a year-on-year growth of nearly 40%. According to the Shanghai Municipal Administration of Culture and Tourism, Shanghai received 7.14 million foreign tourists in 2025, also a new record in annual foreign tourist arrivals. This could have a positive impact on visitor numbers for our flagship Shanghai Ocean Aquarium.

Singapore’s economy grew 4.8% in 2025, up from 4.4% growth in 2024, according to the advanced estimates released by the Ministry of Trade and Industry (“MTI”). On the tourism sector, Singapore recorded 15.55 million in visitor arrivals for the 11 months period up till November 2025, up 2.7% year-on-year. However, it was reported that international visitor arrivals are likely to remain below pre-pandemic levels in 2026 and may not surpass 2019’s peak of 19.1 million, weighed down by global uncertainty, China’s slow recovery in outbound travel, intensified competition from visa- liberalizing destinations, and the strong Singapore dollar.